In today’s fast-evolving, cost-sensitive, and service-driven supply chain landscape, determining how many distribution centers (DCs) operate and where to locate them is a strategic decision with long-term implications. It affects cost, speed, scalability, customer experience, and competitive advantage.

At the heart of this decision lies a quantitative technique known as Geographic Center of Gravity (CoG) Modeling. This powerful analytical method helps supply chain professionals and executives optimize the number, location, and role of distribution facilities based on data-driven tradeoffs between transportation costs, service levels, and regional constraints.

This article provides an exploration into how Geographic Center of Gravity Modeling is used to answer four essential supply chain design questions:

- How many distribution centers (DCs) are optimal?

- Where should each DC be located?

- What inventory should be housed in each DC?

- Which customers should be served from each DC?

In addressing these questions, we’ll incorporate a blend of quantitative modeling techniques and real-world constraints, including inbound and outbound transportation costs, facility and labor economics, tax policy, and incentive programs. This guide is designed for decision-makers, engineers, and logistics professionals seeking to align distribution network strategies with operational and financial objectives.

Geographic Center of Gravity Modeling: A Primer

The Center of Gravity (CoG) method is a mathematical approach for locating a point (or multiple points) that minimizes weighted distances between origins and destinations. In supply chain terms, it helps determine the optimal location(s) for DCs to reduce the sum of transportation costs while considering demand volumes, supply origins, and other constraints.

There are two types of Geographic Center of Gravity models:

- Single-point CoG models: Ideal for businesses with a single facility or hub-and-spoke model.

- Multi-point CoG models: Used to optimize multiple DCs simultaneously, balancing between regional demand clusters and cost structures.

These models rely on a variety of inputs, including:

- Customer ship-to locations and demand volumes

- Supplier ship-from locations and volumes

- Modes of transportation and cost per mile per mode

- Transit time or service level commitments

- Geographic constraints and opportunity factors (e.g., taxes, incentives)

Determining the Optimal Number of Distribution Centers

Objective: Balance Service Level with Cost

At its core, the number of DCs must reflect a tradeoff between customer service (speed of delivery) and supply chain cost. Too few DCs, and delivery times suffer. Too many, and costs balloon due to redundancy in inventory, infrastructure, and labor.

Modeling Methodology

The process begins by simulating distribution cost and service level outcomes for different numbers of DCs, typically ranging from one to ten. Each iteration includes:

- Geographic Center of Gravity analysis to determine candidate locations

- Distance matrices between DCs and customer locations

- Transportation cost modeling by mode (e.g., truckload, LTL, parcel)

- Service level simulation, often using time-in-transit or zone metrics

- Inventory cost modeling based on safety stock and SKU stratification

The goal is to find the point at which the marginal benefit of adding a new DC is outweighed by the incremental cost it introduces.

Rule of Thumb: Diminishing Returns Beyond 3–5 DCs

While each business is different, CoG studies often find that:

- One to two DCs minimize cost but deliver longer transit times

- Three to five DCs optimize the balance of 2-day delivery coverage and cost

- More than five DCs begin to erode cost advantage due to fragmented inventory and higher facility overhead

Locating Distribution Centers Strategically

Understanding the Cost Landscape

Locating a DC is not just about putting a pin in the geographic middle of your customers. Instead, it must account for:

- Inbound costs from suppliers (port, factory, or vendor origins)

- Outbound transportation costs to customers

- Labor availability and wage differentials

- Operating costs (rent, utilities, insurance)

- Taxation and regulatory environment

- Local incentives and abatements

Weighted Center of Gravity Formula

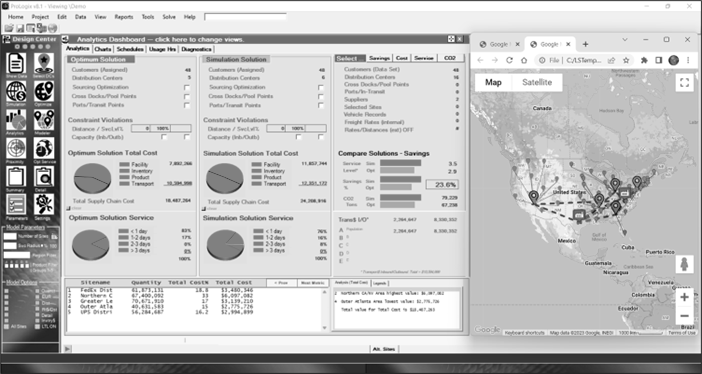

The classic CoG formula uses latitude/longitude data and demand volume to weight the center. For each customer (i), with coordinates (Xi, Yi) and weight Wi (e.g., annual demand), the center is calculated. This gives an unencumbered central location, but more advanced models, such as those used by OPSdesign Consulting, incorporate transportation rates and network constraints to find the cost-adjusted center of gravity.

Inbound vs. Outbound Cost Tradeoffs

The optimal location often requires balancing:

- Inbound economies: Near ports, suppliers, or intermodal hubs

- Outbound efficiency: Proximity to demand centers for parcel or LTL service zones

In a CoG scenario, a “pull east” effect is common in the U.S. because inbound freight enters from the West Coast, but outbound demand is often concentrated along the East Coast.

Assigning Inventory to Each DC: What Should Be Stocked Where?

SKU Rationalization and Classification

The key is to align inventory placement with demand velocity, variability, and service promise. Start by segmenting SKUs using:

- ABC classification: Based on order frequency or volume

- Demand variability: Coefficient of variation (CV)

- Value density: High-dollar, low-volume vs. bulk

Inventory Allocation Strategies

Centralized Inventory (1–2 DCs)

- Advantages: High inventory turns, reduced safety stock, simple control

- Disadvantages: Longer lead times, higher outbound cost

Ideal for: Slow movers, high-value SKUs, low service sensitivity

Regionalized Inventory (3–5+ DCs)

- Advantages: Faster service, lower parcel costs, better responsiveness

- Disadvantages: Higher safety stock, more complex inventory control

Ideal for: Fast movers, promotional items, low-margin SKUs

Inventory Modeling Inputs

Inventory placement models should incorporate the following:

- Demand forecasts by region

- Lead time variability from supplier to DC

- Transportation mode and service constraints

- Holding costs, including the opportunity cost of capital

- DC throughput and slotting constraints

Tools such as multi-echelon inventory optimization (MEIO) can be layered into CoG modeling to account for inventory cost implications.

Customer Assignment: Who Gets Served from Where?

Service Zones Based on Transit Time and Freight Class

Customers are assigned to DCs based on:

- Proximity to DCs: (measured in drive time or miles)

- Freight mode: Parcel carriers use zone-based pricing; LTL uses freight class and density

- Service level requirement: E.g., 1-day vs. 2-day delivery promises

- Order volume: Large customers may warrant direct shipments from a dedicated DC

Zip Code Mapping and Transit Matrices

A common approach is to map each customer zip code to the nearest DC based on:

- Static miles (straight-line or road miles)

- Dynamic carrier routing data (e.g., FedEx, UPS zone maps)

- Historical transit data to validate predicted coverage

Then, aggregate weighted transit times and costs across all customers to evaluate which configuration offers the optimal tradeoff.

Cost Considerations in Geographic Center of Gravity Modeling

Inbound Transportation Costs

Inbound modeling must capture:

- Supplier locations (domestic and international)

- Port of entry and intermodal costs

- Transportation mode (container, rail, TL)

- Lanes and volumes, including full vs. less-than-truckload

- Drayage and demurrage charges near ports

Inbound-centric modeling often supports coastal DC placement, especially in import-heavy operations.

Outbound Transportation Costs

Outbound shipping typically represents the largest cost component in a distribution network. It includes:

- Parcel: Driven by zones, DIM weight, and service levels

- LTL and TL: Mode selection depends on order size and delivery schedule

- Fuel surcharges, accessorials, and density penalties

Facility Operating Costs

These vary widely by region and impact total landed cost:

- Lease or real estate rates

- Utilities (electricity, gas, water, HVAC needs)

- Insurance premiums

- Maintenance and security expenses

For example, operating costs in inland Tier 2 markets (e.g., Indianapolis, Louisville) are often 15–25% lower than coastal urban areas (e.g., LA, New York).

Labor Considerations: Cost, Availability, and Stability

Labor Market Analysis

Labor accounts for 50–70% of DC operating cost in manual environments. CoG modeling must overlay:

- Average wage rates by role (e.g., pickers, forklift operators)

- Turnover rates and absenteeism

- Availability of workforce within a 30-mile radius

- Competing employers and market saturation

Labor Quality and Skill

In more mechanized or automated DCs, labor skill becomes a differentiator. High-tech facilities require:

- Trained maintenance techs

- WMS and automation operators

- Safety-focused supervisory staff

Regulatory Environment, Taxes, and Incentives

Tax Considerations

Distribution operations are affected by:

- Corporate income tax rates

- Sales tax nexus

- Inventory tax (some states tax stored goods)

- Property tax differentials

States like Texas and Florida often perform well in Geographic Center of Gravity modeling due to a lack of inventory and state income tax, making them attractive for regional DCs.

Incentive Programs

Many regions offer:

- Property tax abatements for new facilities

- Cash grants tied to job creation

- Training reimbursements via workforce boards

- Fast-track permitting and zoning support

Modeling should include estimated present value of incentives over a 5- to 10-year horizon when comparing location options.

Modeling Methodology: Step-by-Step Process

Step 1: Define Scope and Objectives

- Geographic coverage (U.S., North America, global)

- Product scope (all SKUs, fast movers only)

- Service level goals (e.g., 95% delivered within 2 days)

Step 2: Collect and Cleanse Data

- Customer ship-to locations and order volumes

- Supplier ship-from locations and order frequency

- Current transportation rates and lane costs

- Facility cost assumptions by region

- Labor market benchmarks

- Tax and incentive data

Step 3: Build Baseline Model

- Map current network, cost, and service outcomes

- Identify pain points or gaps (e.g., long delivery zones)

Step 4: Run Iterative Scenarios

- 1–7 DC configurations

- Fixed (as in the case of an existing owned DC or one with a long lease) vs. greenfield sites

- Centralized vs. decentralized inventory

- Cost vs. service emphasis weighting

Step 5: Evaluate Scenarios

- Total landed cost (inbound + outbound + inventory + facility)

- Weighted service level (e.g., % of orders delivered within 2 days)

- Strategic alignment (growth markets, customer proximity)

Step 6: Select and Validate Final Design

- Conduct sensitivity analysis (volume shifts, carrier cost increases)

- Visit shortlisted markets

- Confirm infrastructure, labor, and incentive alignment

Practical Considerations for Implementation

Change Management and Phasing

- Consider pilot DCs in new regions before full rollout

- Use parallel run periods to de-risk transitions

- Communicate clearly with carriers, suppliers, and customers

Multi-Client and 3PL Options

If volumes are insufficient to justify dedicated facilities, explore:

- 3PL-run shared DCs in modeled CoG locations

- Drop shipping or vendor direct-ship for long-tail SKUs

- Cross-dock hubs to consolidate shipments

Omnichannel Flexibility

Modern DCs must serve:

- E-commerce orders (parcel)

- Retail replenishment (TL/LTL)

- Store fulfillment (BOPIS, returns)

Factor in dock configuration, automation scalability, and order profile diversity.

Conclusion: Strategic Advantage Through Network Science

Geographic Center of Gravity Modeling is more than a math exercise—it is a foundational tool for supply chain transformation. When properly executed, it delivers:

- Lower total logistics cost

- Faster and more predictable delivery

- Smarter inventory allocation

- Strategic proximity to customers and suppliers

- Improved labor and tax positioning

- Future-ready infrastructure

By systematically addressing the core questions, such as how many DCs, where to locate them, what inventory to stock, and which customers to serve, supply chain leaders can unlock both operational efficiency and strategic agility.

However, success depends not only on the model itself but also on the discipline of execution. Organizations must maintain up-to-date data, monitor changes in transportation markets and tax policy, and regularly revalidate assumptions through dynamic scenario modeling.

In a world of unpredictable demand, rising transportation costs, and service-level inflation, mastering Geographic Center of Gravity modeling isn’t optional; it’s essential. OPSdesign Consulting builds and runs geographic center of gravity models to optimize supply chains.