Global spending on emerging warehouse technologies has surged in recent years, with North America and Europe leading the charge. North America currently dominates warehouse automation and robotics deployment, with Europe holding a strong second place. Yet, each region exhibits distinct trends in the types of technologies embraced and the pace of adoption, shaped by differences in market drivers, labor conditions, and regulatory environments.

This report analyzes emerging warehouse technologies, focusing on a comparison between North America and Europe. We examine material handling automation, storage and retrieval systems, and systems technology. Current trends are discussed alongside future developments, highlighting major solution providers, innovation drivers, and the impact of labor and regulatory environments.

Material Handling Automation: Robotics and AGVs

North America: Robotics Boom in E-commerce Fulfillment

North America’s adoption of warehouse robotics has accelerated rapidly, led by the massive growth of e-commerce and the drive for productivity. Large e-commerce and retail companies have deployed fleets of mobile robots for picking and packing. Retailers have partnered with automation firms to automate distribution centers with case-handling robots.

Factors such as persistent labor shortages, rising labor costs, and large warehouse sizes have driven the robotics boom. North American firms also emphasize AI-driven robotics. AI for vision and decision-making enables robots to perform complex tasks like item picking or sorting, expanding automation into new operational areas.

Reshoring of manufacturing to the U.S. and Mexico is increasing the need for automated pallet-handling systems. As a result, automated pallet cranes and shuttle systems are being installed in tall U.S. warehouses to maximize space and throughput. Flexible AMR-based goods-to-person systems offer a lower-cost entry point for smaller operations.

Mobile robotics for order picking has proliferated, with many providers deploying tote-carrying robots in American warehouses, assisting human pickers and reducing unproductive walking time.

Europe: Pioneering Automated Handling in Diverse Sectors

Europe has a long history of warehouse automation, particularly in countries like Germany, the Netherlands, and France. Europe emphasizes robotics for handling tasks in manufacturing and grocery distribution, aligning with Industry 4.0 initiatives.

Automated guided vehicles and conveyors have been common in European factories and distribution centers for decades. Collaborative robotics is a strong focus, reflecting stricter workplace safety norms. Robotic palletizers and depalletizers are often used alongside human workers.

Labor shortages, aging workforces, and high labor costs drive automation. Europe has excelled in goods-to-person automation, with widespread adoption of modular cube-based storage systems and grocery fulfillment systems. High-bay automated warehouses for food, beverage, and retail industries are common.

Europe also emphasizes interoperability standards, allowing multi-vendor robot fleets to operate together seamlessly.

Advanced Storage Systems: High-Density Storage and Retrieval

North America: Scaling Up Density in the Age of E-commerce

Traditionally characterized by sprawling single-story warehouses, North America is shifting towards high-density storage systems. Automated high-bay warehouses and shuttle-based storage systems are seeing a surge in adoption.

High-bay pallet warehouses are emerging warehouse technologies for retail, third-party logistics, and manufacturing reshoring. Shuttle systems for case- and tote-handling are popular in e-commerce fulfillment. Micro-fulfillment centers within or near retail stores are another growing trend.

Vertical Lift Modules and carousels are being adopted to save space and improve ergonomics. Although most warehouses still operate manually, the trend toward greater automation is clear.

Future developments include integration of AS/RS with robotics, lights-out storage systems, and flexible modular automation solutions.

Europe: Maximizing Space with AS/RS and Vertical Solutions

Europe has championed high-density storage solutions for decades, driven by high land costs and urban space constraints. Automated high-bay warehouses serviced by cranes are a hallmark of European logistics.

In retail and grocery sectors, Europe extensively uses AS/RS and conveyor-based systems for distribution. Vertical Lift Modules are widely used for storing high-value or small items.

Automation is being retrofitted into older facilities, adapting compact AS/RS to irregular building shapes. IoT-driven condition monitoring and energy usage tracking are common, aligned with Europe’s focus on sustainability and operational efficiency.

Fire safety regulations and machinery safety standards are stringent, influencing design and automation choices.

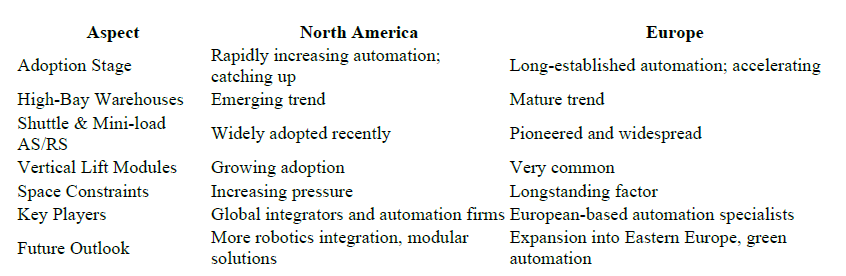

Comparative Summary of Storage Tech Adoption

Warehouse Management Systems (WMS)

A WMS is foundational for efficient warehouse operations. Both North America and Europe have high WMS adoption among medium and large warehouses.

North America favors specialized WMS vendors, while Europe has strong enterprise software adoption. North America is quicker to adopt cloud WMS, while Europe has been more cautious due to data privacy concerns.

Integration with Warehouse Execution Systems (WES) is increasingly important as automation scales.

AI and Analytics in the Warehouse

North American companies prioritize AI/ML investments for optimizing slotting, labor planning, predictive maintenance, and inventory control. Emerging warehouse technologies include the use of generative AI for simulations and training.

Europe adopts AI more cautiously, focusing on automation control and demand forecasting. Practical applications like vision-picking and inventory management are growing.

Internet of Things (IoT) and Connectivity

IoT adoption is increasing in both regions, covering RFID tracking, real-time location systems, environmental monitoring, and wearable devices.

North America invests heavily in telematics for forklifts and RFID in retail supply chains. Europe emphasizes IoT for predictive maintenance, condition monitoring, and energy optimization.

Private 5G networks are being deployed in both regions to ensure reliable wireless connectivity in automated warehouses.

Key Players and Innovation Drivers

Key players driving innovation include global integrators, automation manufacturers, and software providers. Robotics companies specializing in AMRs, shuttle systems, and storage system specialists are prominent.

Innovation is driven by e-commerce growth, labor shortages, safety and ergonomics, customer service demands, resilience, and sustainability goals.

Labor and Regulatory Environment Differences

- Labor Availability: Both regions face shortages, but Europe’s aging demographics amplify the pressure.

- Workplace Culture: Europe emphasizes structured training; North America seeks to reduce hiring churn with automation.

- Unions and Regulations: Europe’s strong unions and safety laws shape adoption of emerging warehouse technologies; North America has fewer constraints but faces growing public scrutiny.

- Privacy: GDPR affects IoT and AI usage in Europe more than in North America.

- Government Incentives: Europe offers more direct subsidies and support for automation compared to North America.

Future Outlook and New Emerging Warehouse Technologies

- Robots will become ubiquitous, with smarter autonomous forklifts, swarms of drones, and advanced picking arms.

- Human-robot collaboration will grow, with wearable robotics and smart wearables enhancing human capabilities.

- AI-driven warehouse optimization will become standard.

- Digital twins and IoT will create smart, connected warehouse environments.

- Flexible, resilient warehouses designed for dynamic demands will emerge.

- Sustainability will shape emerging warehouse technologies, especially in Europe.

- Regulatory evolution will encourage ethical and efficient automation adoption.

Both North America and Europe are heading toward smarter, more automated warehouses. Organizations investing strategically in technology today will thrive in the increasingly competitive logistics landscape of tomorrow.